10 March 27, 2014 2014 LOGAN COUNTY FARM OUTLOOK MAGAZINE LINCOLN DAILY NEWS.com

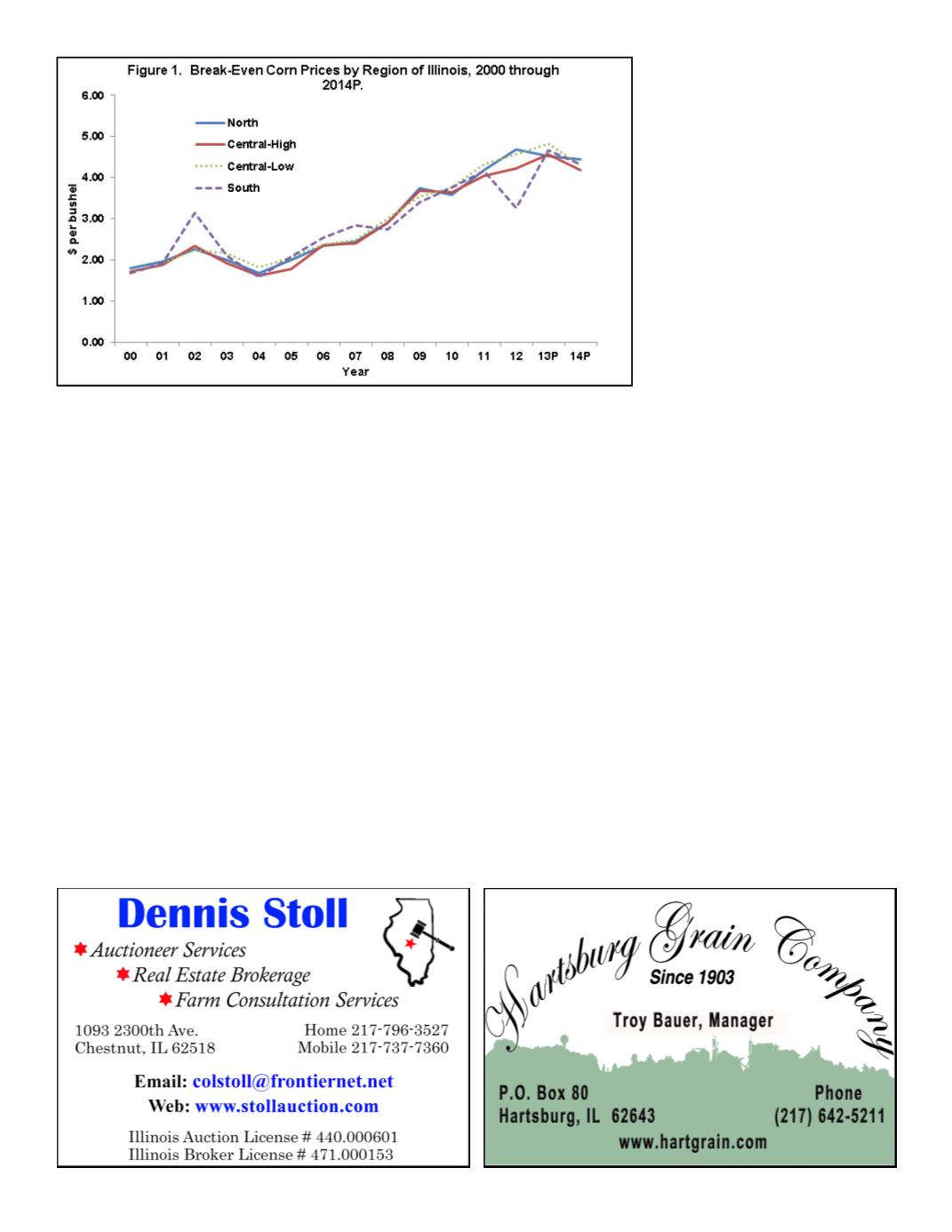

The break-even rate has steadily increased since 2004.

At that time, break-even prices averaged $1.67 per

bushel. Between 2004 and 2013, break-even prices

increased each year: $1.98 in 2005, $2.40 in 2006,

$2.54 in 2007, $2.88 in 2008, $3.59 in 2009, $3.69 in

2010, $4.18 in 2012, $4.19 in 2012 and $4.65 in 2013.

The increase in this dollar amount can be attributed to

both increased non-land costs and increased cash rent.

According to data provided by the University of

Illinois, this era of pricing has been marked by an

interesting pattern. Corn and soybean prices have

likely finished what have been, by historical standards,

very long runs of above-average prices. In addition,

it is unlikely that such prices will return in the near

future. However, the same data shows that it is also

atypical for a long run of above-average prices to be

followed by a long run of below-average prices. It is

more likely that any resulting trend of low prices will

be shorter than the preceding trend of high prices.

Some believe that the high corn

prices since 2006 have stimulated

an increase in foreign corn

production. The USDA estimates

the 2013 foreign production

of corn to be 46 percent larger

than production in 2006. Based

on historical data, corn acreage

outside the United States may

stabilize following the recent

decline in prices, but a substantial

reduction in acreage would not

be expected. In order for that to

happen, foreign markets would

have to witness a combination of

poor weather and lower yields.

A small increase in domestic demand for corn could

also be generated by an expansion in broiler and hog

production.

The most common reason for potentially higher corn

prices next year is the expectation that U.S. producers

will trim acreage and production in response to the

decline in corn prices.

Overall, it is very likely that the next couple of years

will see a decrease in corn prices, with some farmers

simply trying to break even. However, all is not lost,

and if history does indeed repeat itself, we will likely

see another increase in prices, even if the levels are not

as high as in recent years.

“There will probably be some cushion, and there

already has been in the market we are seeing now,” says

Fulton.

Continued to page 12